- Talk To Our Experts : +91-000000000

Backtesting in AmiBroker

Backtesting in AmiBroker

Prior to getting into any details or skill, we genuinely must realize what do we mean by backtesting in Amibroker.

Backtesting is a simple interaction utilized by Brokers to assess the Exchanging Thoughts and gives data with respect to how great is an exchanging framework in view of verifiable datasets. Definitively, it discusses the way of behaving of the exchanging framework, takes a chance with engaged with a specific exchanging framework, and seriously in regards to the presentation of the exchanging framework.

There is one such program AmiBroker which carries out this multitude of roles and does substantially more for the dealers.

Introduction

To keep it straightforward, AmiBroker is an undeniable expert Specialized Investigation and diagramming device which can be utilized by the merchants to Dissect Market, plan outlines, and for backtesting exchanging techniques.

You genuinely must be familiar with AmiBroker is prior to utilizing it to backtest. Better settle on an educated choice instead of simply going with a component that you could lament later (which you will not!)

Features of AmiBroker

Here is a rundown of elements which are presented by the exchanging stage separated from backtesting-

Analysis Window –

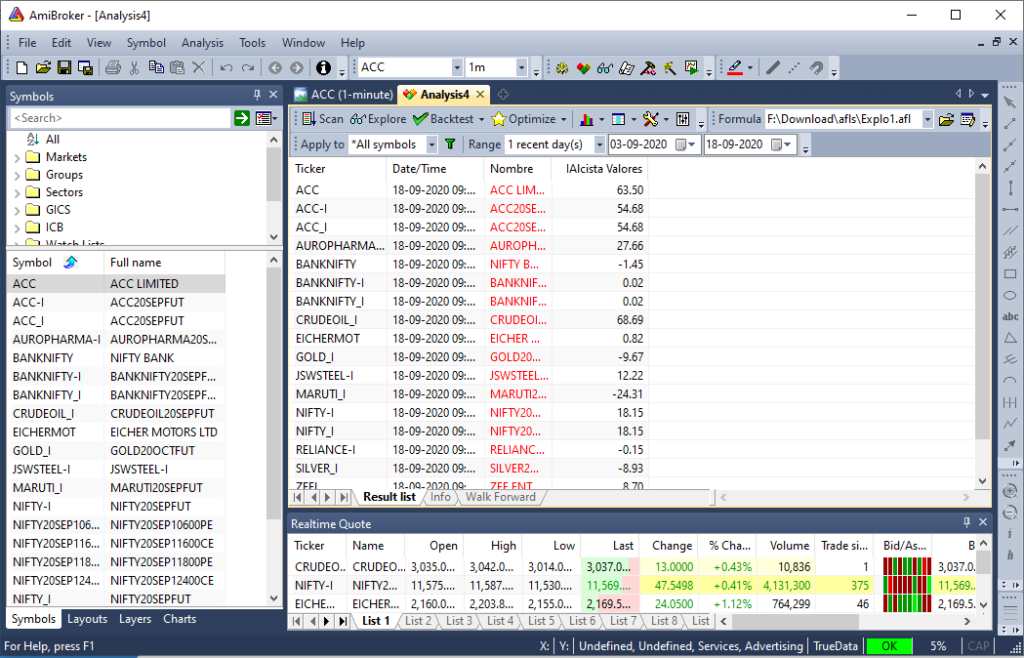

On the investigation window, you will actually want to see nearly everything, for example portfolio, stroll forward tests, streamlining, backtests, investigations, Monte Carlo Recreation, etc.

Exploration/Market Screening –

AmiBroker is a multi-reason instrument for information screening/mining which supplies programmable result with limitless lines and sections.

Graphing –

This element of Outlining in AmiBroker accompanies a few implicit pointers, numerous time spans (which can be utilized according to your own comfort), simplified markers, adaptable boundaries, object making capacities, and so forth. Sliders are the great choices to change boundaries progressively and can likewise redo it in different styles and slopes.

Stroll forward Testing –

It is great for affirming the heartiness of the exchanging test when improvement.

Multi-Stringing –

AmiBroker allots various strings for every illustrations renderer and every recipe diagram.

Code Proofreader –

The code proofreader joins together with boundary call-tips, auto indenting, code collapsing, and so on. At the point when you experience a blunder, a significant message cautions you expeditiously.

Ranking and Scoring –

It is used to perform bar-by-bar ranking depending upon the user score to find a suitable trade.

Advantages of AmiBroker

- It provides the user with top-notch technical support for trading accounts.

- The main features of this tool are fast array and matrix processing.

- AmiBroker ensures that the traders are provided with safe and full-proof trading support in order to have 100% security and that you don’t lose money.

- The features of AmiBroker are customizable and flexible.

- It is the fastest backtesting tool and provides the user with a custom backtesting facility, custom metrics, rotational trading, etc. Also, it provides the user with advanced ranking, scoring, and positioning.

The most productive thing that can be done in the analysis window is to backtest the trading strategy on historical data. It helps you to gain insight into the strengths and weaknesses of the system before you begin to invest real money.

And thus, AmiBroker is a feature which can help you to save lots of money.

Writing Your Trading Rules

The main thing that should be done is that you should have evenhanded or mechanical principles to enter and leave the market. This step is vital to make a base of your procedure and whether the framework coordinates with risk resistance, portfolio size, cash the executives strategies, and a few different elements.

Whenever you have laid out rules for exchanging, you should keep in touch with them as trade rules in AmiBroker Equation Language.

Backtesting

To Backtesting in AmiBroker, you need to tap on the Backtest button in the Customized assessment window. Ensure that you have created the recipes which contain exchange trading rules. At the point when the right recipe is set, AmiBroker starts to explore pictures according to trading rules and makes a summary of imitated trades. This cycle is quick in phrasing that you can without a very remarkable stretch backtest extraordinary many pictures in the blink of an eye. There is a progression window that will show the surveyed summit time. Expecting you wish to stop the cycle at some arbitrary spot of time, click on the Drop decision in the headway window.

Analyzing Results

At the point when the cycle is finished, you will be given a rundown of mimicked exchanges the base piece of the Programmed examination window otherwise known as the Outcomes sheet. Here, you can look at when the trade signals happen simply by double tapping on the exchange the Outcomes sheet. Post this, you are given crude or unfiltered signals for each bar where trade conditions are met. On the off chance that you wish to see just a solitary exchange bolt (opening and shutting as of now chosen exchange) you are expected to double tap a line while holding the SHIFT key pushed down. The other choice that you can pick is the sort of show by picking the proper thing from the setting menu which shows up once you click on the outcomes sheet with a right-click.

Notwithstanding the outcomes, you will likewise be given itemized insights on the presentation of your framework by picking the Report choice.

Changing Your Backtesting Settings

Backtesting in AmiBroker utilizes predefined values for playing out its assignment including portfolio size, periodicity, for example everyday/week after week/month to month, measure of commission, kind of exchanges, cost fields, loan fees, etc. These settings can be changed by the client settings window. Post changing the settings, you should make sure to run your backtesting assuming you wish the outcomes to be in-a state of harmony with the settings.