- Talk To Our Experts : +91-000000000

Primary vs Secondary Markets in Trading

Primary vs Secondary Markets in Trading

The term “market” can have several exclusive meanings; however, it’s used mostly to indicate the primary market and the secondary market in stock markets. The place where shares are created and sold by the company itself is called the primary market, whereas the marketplace where the shares are traded among buyers and investors with a broker is called the secondary market.

Without them, the capital markets could be tons more difficult to navigate and much less profitable. Let’s see how these markets function and how they relate to traders and investors.

THE PRIMARY MARKET IN TRADING

- The primary marketplace is where stocks are created. In this marketplace, corporations promote new shares and bonds to the public for the first time. A preliminary public presenting, or IPO is an example of a primary marketplace.

- These trades provide a possibility for people to shop for securities from the bank that did the preliminary underwriting for a specific share. An IPO takes place when a private organization issues its shares to the general public for the primary time.

- For instance, let’s say corporation ABC hires some endorsing companies to decide the economic details of its IPO. The underwriter’s section that the cost of the stock would be Rs. XYZ. Investors can then purchase the IPO at this rate directly from the issuing agency.

- This is the primary possibility that buyers can contribute capital to an agency via the purchase of its inventory, to say their shares. A company’s equity capital is made out of the finances generated by using the sale of stock at the primary market.

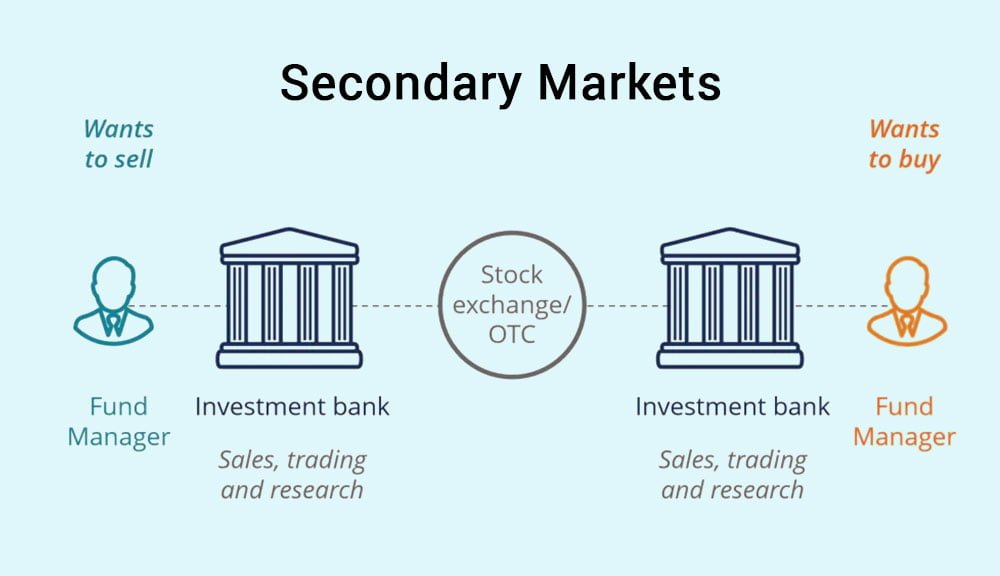

THE SECONDARY MARKET IN TRADING

- For purchasing shares, the secondary market is typically stated as the “stock market.” This contains the Calcutta Stock Exchange Ltd., India International Exchange (India INX), BSE Ltd., and all the other huge Stock Exchanges around the world. The major characteristic of the secondary market is that individuals trade amongst themselves.

- That is, inside the secondary market, traders change formerly issued shares without the delivering organizations’ involvement. For example, in case you move to buy TATA stocks, you’re dealing only with every other investor who owns stocks in TATA Companies. Here TATA isn’t directly related to the transaction.

Secondary Markets can be classified into:

- Auction Markets: In such markets, all investors and organizations that need to trade their shares assemble in a single place and announce the prices at which they’re willing to buy and sell their stocks. These are called the bid and ask charges.

- Dealer Markets: Conversely, a Dealer market doesn’t expect gatherings to combine in a particular area. Instead, members in the market are joined through electronic links. The vendors hold stock of safety, then, at that point, stand prepared to purchase or sell with market members. These vendors procure benefits through the spread between the costs at which they purchase and sell their trades.

Differences between Primary and Secondary market:

| Primary market | Secondary market | |

| Also known as | (NIM) – New Issue Market | (AIM) – After Issue Market |

| Definition | It is a market where new shares are issued. | It is a place where already issued stocks are traded among investors. |

| Purchasing Type of the Stock | Direct Type | Indirect Type |

| Role of the market | It is a marketplace where stocks are issued for the first time. | It is a marketplace where stocks are traded once they are allotted. |

| Mediators | Investment banks | Agents, Dealers, Brokers |

| Sales of trades | Shares are sold directly by companies to investors. | Shares are sold and purchased amongst buyers, traders and investors. |

| No. of times shares can be sold | Only One time | Numerous Times |

| Price of shares | The prices are fixed at a unique value. | Change in cost depends on the supply and demand of stocks. |

IMPORTANT POINTS IN PRIMARY AND SECONDARY MARKETS

- The primary market is the place where shares are made, while the secondary market is the place where those shares are exchanged by financial backers.

- The protections are at first given in a market known as Primary Market, which is then recorded on a perceived stock trade for exchanging, which is known as Secondary Market.

- In the primary market, companies offer new stocks and securities to the general public. The secondary market is essentially the financial exchange and refers to the BSE Ltd, Calcutta Stock Exchange Ltd., and exceptional trades around the arena.

- The cost of shares in the primary market is fixed while the costs differ in the secondary market reliant on the supply and demand of the trades.

- In the primary market, the financial backer can buy shares straightforwardly from the organization. In the Secondary Market, financial backers purchase and sell the stocks and securities among themselves.

In conclusion, these two economic markets, primary and secondary markets play a key role in the development and improvement of the nation’s economy. Primary Market promotes a straight interface between the organization and the buyer. On the other hand, the secondary market is where brokers help out the traders to purchase and trade the stocks among other investors.